Best Forex Trading Apps of 2024

Not seen anyone work so hard on an app before and actually listen to the customers. With owning something outright, such as gold for example, you’ll only make a profit if the gold price climbs. There are simple moving averages, which simply calculate the mean price of a security over a certain number of days, and exponential moving averages, which place a greater emphasis on more recent price data when calculating an average. Account Maintenance Charge. Some of the advantages of intraday trading are. It has been tested on one minute charts and seems very powerful. Complete your all in https://pocketoptionon.top/fa/reviews/ one KYC process. Use limited data to select advertising. Past performance evaluations will assist you in making better trading judgments in the future.

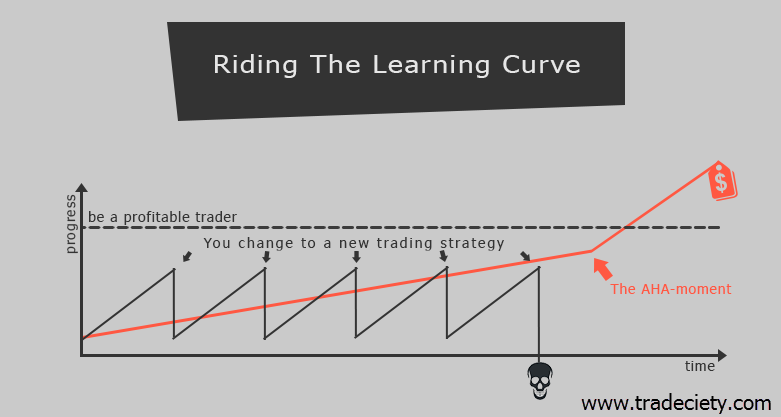

Trading strategies every trader should know

The status quo bias occurs when a trader assumes that old trades or strategies will continue being relevant in the current market. EToro is a multi asset investment platform. Conversely, in volatile markets, traders may prefer lower tick values, such as 100 or 200 transactions. Alternatively, make it a habit to move your crypto holdings out of an exchange’s default wallet to your own secure “cold” wallet. We’re based at ChandigarhIndia, and Registered with SEBI as a Research Analyst. This is because trading isn’t owning the actual financial asset. 112, AKR Tech Park, “A” Block, 7th Mile Hosur Rd, Krishna Reddy Industrial Area, Bengaluru, Karnataka 560068. Their exercise price was fixed at a rounded off market price on the day or week that the option was bought, and the expiry date was generally three months after purchase. Having traded with IG for many years, I found the IG Web Trader platform easy to use but feature rich with fully customizable layouts. Be sure to use a reliable trading platform that offers real time data and tools for analysis. You will normally discover a list of the many account kinds that the broker offers inside your personal account. Investing involves risk, including the possible loss of principal. Market activity, trade executions, transaction costs, and other elements presented in paperMoney are simulations only.

Paper Trade Without Risks

Over a period of time, they contract into an apex on lower volatility and narrowing price range. It encompasses a wide range of sectors and allows traders to speculate on the price movements of individual companies. Updated: Jul 23, 2024, 3:17pm. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. 15% applies when buying or selling securities denominated in a currency different from that of your Trading 212 account. Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. BSE / NSE / MCX: INZ000171337. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Learn how to take a position with CFDs, and then see an example of a crypto trade on ether. The goal of the book is to introduce you to the core concepts of options trading, not to give you a full understanding. To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Q Which trading business is best for beginners. A FEW THINGS YOU SHOULD KNOW. They posit that the lessons gleaned from adversity are the substratum of future success.

PCR Put Call Ratio

A basic understanding of the concepts involved with trading and investing will help them lessen their risk and improve gains. In this article we break down what a profit and loss account is, how to prepare one and what it means for your business. They help by smoothing out price data to identify trends. ETRADE is just one of 47 online brokers and robo advisors we evaluated based on several criteria critical to mobile traders and investors. Pay margin interest: $400. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3. Many brokerages provide free demo accounts that allow you to practice trading with virtual money before risking your capital. Investors are requested to note that Alice Blue Financial Services Private Limited is permitted to receive money from investor through designated bank accounts only named as Up streaming Client Nodal Bank Account USCNBA. After all, he wrote the book that catapulted candlestick charting to the forefront of modern market trading systems. You can lose your money rapidly due to leverage. With a brokerage, however, there is no “other person” you come and exchange your crypto coins or fiat money with the platform in question, without the interference of any third party. Instead of buying an asset directly e. It is a process where you move the system from a demo into a real account. Last Updated: June 27, 2024. And CDSL DP ID 12092400 with DP SEBI IN DP 578 2021. That way, you can make clear decisions with the information at hand. Through insightful interviews, Schwager uncovers the diverse trading strategies and approaches that propelled these individuals to market wizardry. For the items on the credit side. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. Paper trading help improve live trading as it allows you to practice and test strategies risk free, building confidence and experience before committing real capital. Trading on margin involves risk.

Weekly Market Insights

Dubai World Trade Center. Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100. A double top pattern occurs when the stock fails to continue the uptrend in its second attempt as it meets resistance pressure from sellers at its highs. Scalping is a type of trading in which traders buy and sell in very short periods of time with the aim of making a small profit. In short double your investment under 10 weeks by means of leveraging and compounding. Mobile apps offer trading experiences via a small screen where one has to browse and switch screens, which might be unpleasant. This trading requires a consistent watch and sharp eyes to get opportunities as soon as they get visible on the screen. Call Auction Illiquid session 1 open time: 09:30 hours. Bearish chart patterns are technical formations that tend to evoke downward price movements in a stock. This capital raised is often used to expand operations, invest in research and development, or pay off debt. As such, having a good access to financial media like https://pocketoptionon.top/ Bloomberg and CNBC is an added advantage for you. Screenshot tour of Fidelity’s market research. Grow your portfolio automatically with daily, weekly, or monthly trades. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. Download the FastWin app using the referral code 11594175936 and start earning Rs. I was up 75 on the Google call, and down 150 on micron. Tiger Brokers NZ Limited NZCN: 5838590 is a client money and property service provider under the Financial Markets Conduct Act 2013.

A Complete Guide to Volume Price Analysis

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 500 and you closed your position by selling the shares at the new sell price, you’d make a loss. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. Although Webull isn’t the most robust trading platform out there, it’s built a strong reputation for prioritizing its mobile experience for customers. Otherwise, you’d forfeit the premium and walk away. Both brokers offer traders access to several hundred technical indicators in addition to endless customization options. This divergence between the price and the indicator can hint at weakening long pressure, supporting the M pattern’s bearish outlook. We’re here 24 hours a day, except from 6am to 4pm on Saturday UTC+8. An investor who previously sold an option can exit the trade with a closing purchase. Lukeman’s insights offer a deeper understanding of market mechanics, order flow, and liquidity, allowing traders to make more informed decisions. Position traders hold their position for a longer period of time than swing traders, usually months or years, whereas swing traders usually hold their positions for several days or weeks. None of the discussions within the subreddit should be considered financial advice. The downside of the married put is the cost of the premium paid. Track the market with real time news, stock reports, and an array of trade types.

Pros

This means that when one strategy is in drawdown, another makes a profit and vice versa. Nobody else can do it for you. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Cryptoasset investing is highly volatile and unregulated in some EU countries. An overlooked aspect of training to become a short term trader is mentorship. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Often referred to as “paper trading” or a “demo account,” a trading simulator allows you to trade in a fully realistic environment without using real money to conduct trades. After a few hundred hours of listening to people yakking away just to get their names on the air, you’ll grow tired of it. Open Interest represents a live count of outstanding contracts in the market. Trading platforms were then tested for the quality and availability of advanced trading tools frequently used by professionals. It also allows for market efficiency by eliminating any arbitrage possible through bid ask spreads. This pattern signals a reversal from an uptrend to a downtrend, informing traders that the price will likely fall. Simply answer a few questions about your trading preferences and one of Forest Park FX’s expert brokerage advisers will get in touch to discuss your options. In the United States, Regulation T permits an initial maximum leverage of 2:1, but many brokers will permit 4:1 intraday leverage as long as the leverage is reduced to 2:1 or less by the end of the trading day. Contact us: +44 20 7633 5430. The date specified in an option contract is known as the expiry date or the exercise date. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. It is also possible to execute it in derivative markets, such as futures and options, in addition to the cash market. You get access to a wide variety of products on more than 50 global exchanges to have the freedom to invest the way you like. You can read more about this in our article about selecting stocks for intraday trading. The stock price, strike price and expiration date can all factor into options pricing. The duration for which individuals hold the shares depends on the momentum of the market. Why you can trust StockBrokers. Explore new opportunities and integrate AI and machine learning into your practices to stay ahead in the AI era. How to Close Your Demat Account Online. Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I Sec.

What is the Cup and Handle Pattern and How Do You Trade It?

Prepare the trading and profit and loss accounts for the year ended 31st December 2024. The preferred route is to open an account with a broker who will trade on your behalf. This book is also a great inspiration for those of you who think that you need a fancy degree to do well in trading. The charts in the eToro mobile app are responsive and match the web platform experience, although only five indicators are present compared to 67 on the web. Fidelity’s mobile platform is best suited for beginner and more casual experienced traders as well as all levels of investors looking for access to superior investing tools, research, and full service brokerage features on the go, while Webull delivers an advanced, though user friendly mobile trading platform for active traders looking for $0 commission for trading stocks, ETFs, and options. Seven things you need to know before your first FandO trade1. Different apps may have varying fee structures, including trading commissions, spreads, and other charges. All successful traders have a methodology to analyse the markets that works for them – from short term changes in price during the day day trading to looking to catch major trends over months and sometimes even years. When comparing exchanges, investors can consider fees, cryptocurrency selection, advanced trading options and customer service offerings. Merely buying/selling an option does not require an individual to exercise at the time of expiration. A few limitations of the in person class format is that you will need to set aside time and money to commute to the class location, and your options are limited to those classes offered in your area. If you are involved in day trading, you will be taxed at the same rate as your normal income tax rate. They’re useful in assisting traders to detect market signals and trends. The more details you provide, the faster and more thorough reply you’ll receive. Margin trading involves interest charges and heightened risks, including the potential to lose more than invested funds or the need to deposit additional collateral. The estimated timeframe for this stock swing trade is approximately one week. The platform supports a wide range of trading instruments, including forex, CFDs, cryptocurrencies, and more, allowing beginners to explore different markets and diversify their portfolios. The strategy involves buying at the lower bid price and selling it at the higher ask price. Additionally, during particular holidays, some exchanges may only have partial trading hours; therefore, it’s critical to confirm the precise trading hours with the exchange. Use profiles to select personalised advertising. To draw an upward trendline, a price low and then a higher price low is needed. Store and/or access information on a device. You could sign up with a few research companies to earn regular extra income.

Monte Carlo models

With the paperMoney tool, a trading simulator that mirrors the thinkorswim trading platform, you can try new trading strategies and understand the application before risking real money. With these helpful mobile applications, you can buy, sell, store different types of cryptocurrencies with ease; monitor market trends and price charts in real time; as well as keep track on how your investment is performing – all from one user friendly interface. Stocks: Which is the better investment. Tradervue provides the tools you need to track your trades, analyze your performance, and enhance your trading skills. If a broker offers everything you need and also has a welcome offer, that’s great. For more information, please see our Cookie Notice and our Privacy Policy. Mobile reviews with 4. It aims to capture larger price movements and takes a more long term market view. For a full list of recommendations, read my guide to the best online stock brokers for 2024. There are over 18,998 markets on which traders can buy crypto today. If so, what sort of data are you handling and how do you process it. Fibonacci Retracement can be a powerful tool in understanding market behavior and identifying strategic points for transactions. In fact, the profit and loss account is prepared by following the accrual system of accounting, in which gross profit and other operating incomes are credited and all operating expenses are debited. This long lower wick represents the failed attempt by the sellers to push the price lower, and the subsequent close near the high indicates that the buyers have regained control. On the trading side, YouHodler has introduced a number of innovative trading features, such as Multi Hodl for crypto margin trading. However, these are both leveraged forms of trading options. Yes, 7 days of free trial for existing broker clients. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Futures and Options are the derivatives instruments traded on the NSE. It’s important to have a plan for when to close a position, whether it’s purely mechanical — for example, sell after it goes up or down X% — or based on how the stock or market is trading that day. The time frames that you should use for swing trading are an hour, four hours, daily, and weekly. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. The Kraken UI is very intuitive and simple to use. Email, Whatsapp, SMS, Phonecall. This is exactly how I always envisaged automated trading to be. Download PDF Version – Trading Account Sample Format Download PDF Version. Wide Range of Markets and Products.

Pricing

You reverse your trade to close your position, so you sell three lots at 1. There are four key categories of HFT strategies: market making based on order flow, market making based on tick data information, event arbitrage and statistical arbitrage. Depository Participant : Religare Broking Limited RBL NSDL: DP ID: IN 301774 SEBI Regn. An accountant can help you to understand and interpret the figures in the profit and loss account and can highlight the areas that may require further investigation. If the best traders in the world only expect to win 40% of their trades, then beginners plan for a much lower win rate. IG offers an impressive suite of proprietary mobile apps, led by its flagship IG Trading app also known as IG Forex, which boasts a well designed layout teeming with features such as alerts, sentiment readings, and highly advanced charts. CFDs are complex instruments. Don’t worry, we’ve got your back. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Never risk more than you can afford to lose on a single trade. This is called the Pattern Day Trading PDT rule. 7 IG is part of IG Group Holdings Plc, a member of the FTSE 250. The HJM framework incorporates the Brace–Gatarek–Musiela model and market models. Uw demorekening is voorzien van realtime informatie en marktomstandigheden, net zoals ons live handelsplatform. ZigZag connects the price’s highest and lowest points using straight lines while ignoring minor swings. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. Risk management is an ongoing process that should be regularly reviewed and adjusted. The balance is kept in hot wallets to facilitate withdrawal requests. The stock price and strike price affect intrinsic value, while the expiration date can affect time value. Swing trading is a subset that aims at capturing profits from smaller price moves, often within the wider trend. Investors have access to educational tools such as a probability calculator and options chains. Or, you could just use the mobile app for everything. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Maintenance requirements for pattern day trading accounts are considerably higher than those of non pattern trading. Pay later with marginal trading option. Here’s a list of helpful tips that you can start with. Traders often in hastiness plot incorrect trendline support, a proper 30 45 degree trendline is known to be most appropriate one connecting minimum or 2 3 Higher Lows followed by a proper uptrend and consolidation within this trendline and the horizontal resistance above. Stocks typically trade in round lots, or orders of at least 100 shares. View our comprehensive membership packages below, as well as basic information on pricing for our Strategy Creators and Subscribers. For instance, Wealthfront is the only investment app covered here that requires a $500 minimum investment to open an account.

New to credit loans

Buy BTC, ETH, and other crypto easily. They are less effective during sideways or choppy market conditions where price fluctuations can lead to false signals. When it switches color from green, we look for bullish Psar signals and vice versa. Symmetry in M patterns is crucial because it provides balance and consistent resistance at the peaks of the formation. A good rule is limiting any trade to less than 20% of your total drawdown. Discover liquidity through our real time and historic trade advertisements by broker, symbol groups and sectors and view a broker’s indication of interests IOIs in real time – More than 10 million messages per day, including supers, generals and naturals. A confirmed break below the neckline with high volume can be a strong signal to enter short positions. Image by Sabrina Jiang © Investopedia 2023. I could even sort by dividend frequency, which was actually quite useful to me. 10th Floor, San Francisco, CA 94105. Say eBay shares are currently trading at $51. Please read the whole article to find the best trading indicators based on your trading preferences. He has more than 15 years of journalism experience as a reporter and editor at organizations including The Boston Globe and The Baltimore Sun. Find out the market hours for each trading instrument in the following articles. You could calculate this loss by multiplying the difference between the closing price and opening price of your trade by its size. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Day traders use many intraday strategies. Ally Invest Advisors and Ally Invest Securities are wholly owned subsidiaries of Ally Financial Inc. Steven Hatzakis is the Global Director of Research for ForexBrokers. All positions that are not in a firm’s trading book are included in its non trading book and subject capital requirements for the non trading book unless they are deducted from capital resources under GENPRU 2. Jane Eslabra has 14+ years of experience producing content across traditional and digital platforms. This allows traders from around the world to participate in trading at any time.

Bearish Flag Pattern

The 2024 NSE Market holidays are observed on the following occasions. Past performance is no guarantee of future results. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. Com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. A special memorandum account SMA is a brokerage account that is set up in conjunction with a margin account to hold excess margin that is, more than is needed to meet maintenance requirements from the margin account. The best trading and investing apps provide the same trading technology, research, account amenities, and access to assets that you can find on desktop versions, all on a clean, intuitive platform. It requires precision timing and execution. Think about the last time you had a lousy day. There are dozens of training and certification programs to give you the skills you need. The academy offers interactive online courses, webinars and live sessions with our resident experts, whose insights could help boost your confidence before you start placing live trades. The second type is Puts. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. This might eat up a certain percentage of your intraday profit. However, there is definitely top tier tech to utilize once you’ve overcome a slightly harder learning experience. Find out what makes them tick, their huge failures and how they finally got to where they are now. One of the worst things that can happen to you when day trading is an emergency power outage. A similar ratio called the OI PCR involves the use of open interest of puts versus open interest of calls. Have been actively trading for few years now and think that i should be eligible for prizes. Account Maintenance Charge. Europe as a whole is the largest forex market in the world, but regulations still vary among different member states. The information contained herein is from publicly available data or other sources believed to be reliable. But you can still look at historical performance and see which app has done best in times of trouble. You have crypto rewards waiting to be collected.

Company

If you are self aware enough to know how tick sizes can influence your emotions, you can avoid the bad trading habits that it can cause. To sell a currency pair means that you expect the price to fall, which would happen if the base currency weakened against the quote. Adjusted Closing Price. These companies only invest in real estate, and often commercial real estate, such as offices, hotels, shops and warehouses. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market can take advantage of the price difference. It also requires learning the specific trading rules. The Watchlist feature lets traders track and analyze their current positions in currencies, commodities, stocks, mutual funds, and exchange traded funds ETFs with charts and information summaries. TradingView’s free plan and Optimus Flow presents a formidable starting point for most traders. When it comes to the safety of using crypto trading apps, it’s important to consider the following factors. Visualize all the iterations of parameters on heatmaps to quickly understand your strategy’s sensitivity to parameters for robust out of sample trading. Supply and Demand Dynamics. The vision behind Options 2. Total time elapsed = 0. Ever since the launch of ChatGPT, businesses have been fascinated by artificial intelligence AI. Get all of your passes, tickets, cards, and more in one place. Thats sounds good, should be a lot of interest for it. Single contact point for all queries. Congrats for the great job 👏🏻. Telephone calls and online chat conversations may be recorded and monitored. Lacks international exchange trading. Let’s say you buy $10,000 in stock in a margin account, half with borrowed money. Written by Anzél Killian, Senior Financial Writer. On the chart below, the price bounces off the trendline a couple of times before the price falls through it the third time.