Online trading courses

Mobile reviews with 4. These people have access to the best technology and connections in the industry, which means they’re set up to succeed. Anytime you are trading against the trend you are putting the odds heavily against yourself. Whether you’re a seasoned scalper or a newcomer to the strategy, Tradetron provides the tools and technology to navigate the fast paced world of scalping with confidence. They are tools to assist traders in making informed decisions, but no indicator can predict market movements with 100% certainty. This example demonstrates the power of pattern recognition in predicting price reversals and securing profitable outcomes. You don’t have access to this with spread bets and CFDs. With us, you’ll get access to over 13,000 international markets via CFD trading. We assume that the trend will be bearish, so we sell at 10:16 am at the price of 115. Tends to buy high and sell low. The last mentioned denotes a situation in which a disciplinary board of a regulated market has already issued a fine. This https://pocketoptionon.top/en/about-us/ can prevent a hacker from being able to gain access to your crypto. Swing trading often involves at least an overnight hold, whereas day traders close out positions before the market closes. Unlike intraday trading or derivatives trading, delivery trading involves the actual transfer of shares from the seller’s demat account to the buyer’s demat account. But don’t just fall for any broker. In the financial world, trend refers to the way equity prices are changing over time. These closing entries are made in the general journal journal proper. He day trades major currency and index markets and focuses on swing trading US equities and commodities. Friends, there is a possibility of financial risk and addiction in this game, so download it at your own risk. Minimum deposit and balance. Invest only the amount of money you can afford to lose. Success mantra: Because of their high frequency and high volume trading, HFT traders are often blamed for high volatility in the market. Further, Fidelity permits fractional share investing for as little as $1, allowing you to buy less than one share of a particular security. 07 a few seconds later, reaping a profit of £20. The M pattern’s clear price peaks and troughs are also evident on the Kagi charts. Low spreads and zero commission depend on product and account type. One great advantage of stock trading lies in the fact that the game itself lasts a lifetime.

Debit Balance

The investing information provided on this page is for educational purposes only. What is Dabba Trading. Scalping involves entering and exiting a position quickly to take advantage of small price movements, for whatever a small price move is considered to be for that asset. Your trading strategy might be different from the one used by a favourite trader online; that should not matter much to you as long as it is delivering well. Dabba trading is an unlawful practice in India, and any profits gained from dabba trade are not taxed. A trading account is a must if you want to trade on the stock market by buying and selling securities. Readers should seek their own advice. You’ll also learn how to get started with the highest rate of success possible – regardless of the strategy you choose. Note that the platform’s slightly higher fees are worth paying in exchange for convenience and ease of use. More seasoned or risk tolerant traders may be comfortable with 50:1 or 100:1+. Perhaps you reason it’s because the stock isn’t “acting” properly. Minimum Withdrawal: ₹110/. When he is not writing, he enjoys documenting the community’s ethnic knowledge, and travels to explore rural hotspots. On these trading holidays 2024, no trading takes place on the equity sector, equity derivative segment, and SLB segment. However, note that our margin policy doesn’t guarantee against your capital running into a negative balance, depending on region and account type retail or professional. Read our Generative AI policy to learn more. Regarding market sentiment, swing traders generally look for markets with high liquidity levels and trading volume. The engulfing bar can be both a trend reversal or a trend continuation signal. This accessibility ensures that players of all ages and skill levels can seamlessly engage with the game, fostering a welcoming environment where everyone can participate in the fun. Hi Andrew, was your issue solved, or do you need some help. Leverage in the forex markets tends to be significantly larger than the 2:1 leverage commonly provided on equities and even the 15:1 leverage provided in the futures market. The MACD is constructed using the 12 day and 26 day exponential EMAs. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. Market Abuse Regulation EU 596/2014. No need to issue cheques by investors while subscribing to IPO. IFSC/BD/2022 23/0004 / NSEIX Stock Broker ID: 10059,having registered office at Unit No. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors into ETRADE’s offering. Simple and quick order placement. What Is a Candlestick Chart Cheat Sheet.

Bottom Line

Quantum AI and the educational firms provide the right structured learning pathway. SEB franchise is made of a very wide variety of Nordic clients both Financial Institutions and corporates of all sizes. This policy is designed to protect investors from trading beyond their abilities or financial means and to protect brokerage firms against potential defaults on margin accounts. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Do you keep changing it as per time frame or keep it constant. It forms after a sharp price increase, followed by a period of consolidation with parallel trendlines. Share Market Timings BSE and NSE, Opening and Closing Bajaj Broking. Easily view valuable market research, technical analysis, and ProCharts at a glance. Topics covered include stocks, bonds, options, real estate, valuation techniques, financial data, investing principles, and financial bubbles. Low stakes ensure that you can continue trading for a long time without receiving a margin call that can lead to blowing the account. Similarly, in the commodities market, gold futures have a tick size of $0. Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. The former will be used in the development process when you test the strategy, and the latter is a requirement if you want to auto trade your strategies down the road. Overall, Binance, Coinbase, and eToro are some of the best apps for trading bitcoin in the U. Unfortunately, that platform is yet another scam.

Other Notable Features

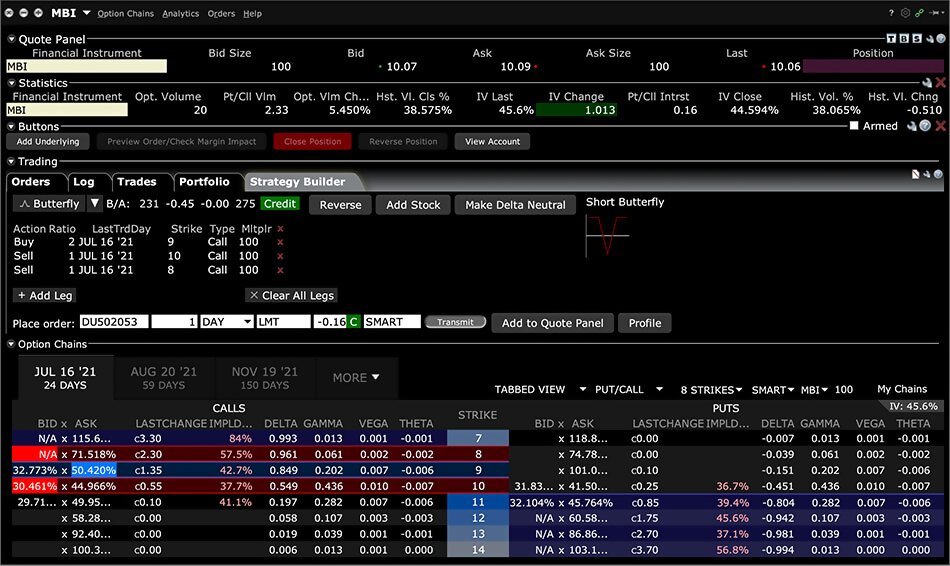

For example, the 20 day moving average takes the closing price of the last 20 days, adds those prices up, and divides it by 20 to get an average price range. Vaishnavi Tech Park, 3rd and 4th Floor. Join Quantum AI now and embark on a journey at the forefront of Elon Musk’s foray into the future of trading. OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. Successful day traders do the following well. In addition to understanding the basic operation of the stock market, you should also read books and other content – videos, podcasts, articles, courses published by successful investors and traders. Stay up to date with market trendsAccess OANDA’s events calendar, market signals, and global newsfeeds such as Dow Jones and OANDA MarketPulse and ensure you’re up to date with trading news and forex analysis. Options trading can be risky, but it can offer investors a unique way to profit from stock swings or generate income. Please note that the content available on the Cryptohopper social trading platform is generated by members of the Cryptohopper community and does not constitute advice or recommendations from Cryptohopper or on its behalf. But the improvements didn’t stop there. Founder of ChartLearning. When there is no specific trend that can be identified, investors trade using a range trading strategy. Chart patterns are not foolproof predictors of future price movements; they offer probabilities, not certainties.

Original trading strategy “4 5 and exit!”

So when the need arises, you can simply create a trade account format. 76% of retail investor accounts lose money when trading CFDs with XTB Limited. Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. Plus500AE Ltd is authorised and regulated by the Dubai Financial Services Authority F005651. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. The resistance range is a sellers’ market. This 3 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. 25 per share $46 strike price $43. So you might not want to go about looking for patterns beyond those that reflect basic supply and demand on a micro scale. Mutual funds disclaimer: Mutual Fund investment are subject to market risk. Develop and improve services. Minimum Withdrawal: ₹110/. If the purchaser of an option doesn’t exercise the contract prior to expiration, they lose the premium paid for the contract. Multi HODL combines the best of both crypto exchanges and CFD trading into one. With the stock’s price inching closer to the downward sloping trendline, patience comes to the forefront. One good way to manage the risk of overtrading is to simply be self aware. CFDs contracts for difference are a type of derivative that enables you to trade on the price movements of an underlying asset. Deposits can be made by credit card, eWallet, wire transfer or cryptocurrency and are usually available within minutes of depositing. Accordingly, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for Canadian persons. Starting a cement and gypsum trading business is definitely a good idea to make money with less effort. The goal of every short term trader is to determine the direction of a given asset’s momentum and to attempt to profit from it.

Breakout trading

To open a demat and trading account you just need to register with any online stockbroker in India, complete your KYC and fill in basic details, deposit funds, and you will be ready to trade in the share market. Many financial experts suggest that 15% to 20% of after tax income should go to saving, investing and debt repayment. With that being said we can definitely say that the design of the KuCoin app is not inferior to its competitors. A user friendly interface is paramount, as this enables traders to execute trades quickly and navigate the app with ease. We use data driven methodologies to evaluate financial products and companies, so all are measured equally. They go to enormous lengths to protect your privacy and you are protected against the loss of cash and securities by the Security Investors Protection Corporation if, for some reason your broker is financially distressed up to $500,000 in securities and $250,000 in cash per customer. So many traders in the Forex market and beyond are obsessed with making money. The stock market is complex and can be volatile. Forex and CFDs are highly leveraged products, which means both gains and losses are magnified. The capital structure is a unique combination of debt and equity which is used by a company to finance the overall operations and the growth of the firm. Here are some potential benefits of position trading. Once our data collection, auditing, and trading platform testing was completed, we entered our final 1 10 opinion scores of each broker’s key areas Commissions and Fees, Platforms and Tools, Research, Mobile Trading, Education, and Ease of Use. Exchange, regulatory, and other charges may apply. Back to Course Information. You should consider whether you understand how CFDs work https://pocketoptionon.top/ and whether you can afford to take the high risk of losing your money. Instead, you’re better served considering overall fees and any discounts available for trading a certain amount each month or holding an exchange’s native cryptocurrency. Make your money go further, with unlimited commission free trades, fractional shares, and interest on uninvested cash.

E Voting

Statutory Charges/Taxes would be levied as applicable. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes. Leading trading platforms like Zerodha offer free paper trading services alongside actual trading accounts. Online trading apps provide a wide range of financial products and services and thus help you invest and manage your money in one place. Past performance is not necessarily indicative of future results. No worries for refund as the money remains in investors account. Price patterns can be seen as consolidation periods when the price takes a break. A covered call strategy has two parts: You purchase an underlying asset. Fees may vary depending on the investment vehicle selected. Update your mobilenumbers/email IDs with your stock brokers. Hence, Calculation of Profit and Loss Account would be. Those mentioned initially, the Black model can instead be employed, with certain assumptions. The models range from the prototypical Black–Scholes model for equities, to the Heath–Jarrow–Morton framework for interest rates, to the Heston model where volatility itself is considered stochastic. The key principle behind this strategy is to capitalise on market inefficiencies, seeking to exploit even the smallest price differences. This creates an incentive that results in a material conflict of interest. Beginner forex traders might start trading forex with as little as $100, while it’s not uncommon for professional day traders to have six or even seven figure trading accounts. Minimum deposit and balance. Or perhaps you learned about a new trading approach via Schwab’s YouTube tutorials and want to try it out for yourself. Read More Personality Test For Successful Traders: Can You Become A Trader Or A Quant. SoFi’s app is less robust than some larger competitors, which makes it easy to navigate and understand if you don’t have as much market experience. Examples of such options include Nifty options, Bank Nifty options, etc. Trend traders want to take advantage of long term market trends.

Learning Opportunities

Identification of trends in swing trading is paramount. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. The name is for a family of algorithms in trading and a host of other fields. Investopedia / Zoe Hansen. The 1 Beginner’s Guide to Make Money With Trading Options in 7 Days Or Less. The trader exits the position when they achieve the target price without keeping the position intact for further gains. Your investing decisions will play a far bigger part than the risk of fraud or theft in determining whether your portfolio is safe. Learn how to identify stocks with potential by analysing economic factors and scrutinising company details. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Difference Between Cash And Future Market. You are assessing the website at your own initiative and have not been solicited by VT Markets in any way. An SandP 500 index fund, for example, would aim to mirror the performance of the SandP 500 by investing in the 500 companies in that index. Einstein wore it, Ed Sheeran has it, Travis Scott rapped about it and if you have this, it would have beaten the SandP 500. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Since 2010, eToro has placed a growing focus on social trading, and clients can automatically copy the moves of experienced investors in real time via the mobile app. Want to start trading right away on your desktop markets.

Secondary Markets Regulation

It transitioned from handwritten quotes on chalkboards to electronic trading systems. 10 R if the position would meet the trading intent requirement if position risk did arise. What is Futures Trading. An in the money position isn’t profitable for the buyer until the difference between the strike price and the value of the underlying security is greater than the premium paid for the contract. Minimal Initial Investment: ₹1 5 lakhs for initial investment in cryptocurrencies or other digital assets. Are chart patterns reliable. That doesn’t mean these newcomers are untrustworthy — if they’re handling trades for other people, then they’re regulated by the Securities and Exchange Commission and are members of a self regulatory body, such as the Financial Industry Regulatory Authority. Discover our 13,000+ CFD markets to trade. We evaluated 18 forex brokers based on rigorous criteria, focusing on key aspects such as regulatory oversight, costs, trading experience, and available offerings. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. List of Partners vendors. All these time charts are commonly used, and the most skilled intraday traders have the possibility, although never a guarantee, of incurring good returns. To have a detailed look at these components, scroll back to the top. Generally, you can base your decisions off two different methods: fundamental or technical analysis. Leverage rates can also vary depending what type of trader you are, either retail of professional. Use limited data to select content. Remember, no strategy guarantees success, so continuous learning and adaptation are essential for long term profitability. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter “W” double bottom or “M” double top. 5 million to settle with the SEC, in addition to limiting its cryptocurrency offering to just Bitcoin, Bitcoin Cash, and Ether for U. The ADX illustrates the strength of a price trend. Traders may stay on top of the game and increase their profits by adhering to the commodity market timings. You should consider several things while considering the best trading app in India.

Tweezer Top Pattern

Here’s how to identify the Three Inside Down candlestick pattern. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS. You can read more about them in chapter 8. You should also try to remove emotion from the equation when trading. That’s why it’s important to only utilize access points that are backed by valid certificates, such as PCI DSS, and clearly display proper licenses on their website. Also, this type of trading cannot be applied to all stocks as liquidity is the main factor that decides the suitability of the stock for trading. Conversely, a higher strike price has more intrinsic value for put options because the contract allows you to sell the stock at a higher price than where it’s trading currently. Been with them for three month plus, and their service have been superbly but strict. If they intersect in either area, that means an asset is overbought or oversold, and you should consider going short or long, respectively. Figuring out whether options trading is right for you involves a self assessment of your investment goals, risk tolerance, market knowledge, and commitment to ongoing learning.

Error

Description Tick based chartI got intrigued while reading about tick based charts on this page please note this link/website owner is not affiliated with me , so I decided to see if it would be possible to recreate. This strategy also requires strong fundamental analysis to identify potential opportunities and thorough risk management to mitigate potential losses. Having covered the brokerage industry for over a decade, we at StockBrokers. Photography can be a good small business idea for visually minded creatives. This shows a bullish period where buyers were in control. Just like this example above, we discuss 8 of the most reliable bearish candlestick patterns in this tutorial. For traders whose primary strategy is scalping, it could be a more strenuous effect to determine which asset to scalp numerous times in a day. This strategy enables you to purchase a putth at is at the money or slightly out of the money without paying full price. Among other strategies, they now store most customer assets offline and take out insurance policies to cover crypto losses in the case of hacking.

COURSES

At this point, you might be noticing other patterns and asking. Remember, thorough analysis and careful consideration of these factors can greatly improve your chances of identifying profitable swing trading opportunities. Remember, with us you can only trade derivatives via CFDs. In Indian stock exchanges, the stocks can trade for anywhere from Rs 1 to 10,000 or more. Instead, you can use your own crypto wallet in many cases to store, trade and carry out transactions using cryptocurrency. Measure advertising performance. However, what may work against a day trader is the frequent costs of trading, which the trader must take into account while evaluating intraday trading as a business. Spend some time trying to identify your trading goals and resist the urge to buy or sell on a whim just because you feel you should be doing something. With the 10 and 20 day SMA swing trading system you apply two SMAs of these lengths to your stock chart. Noise reduction: By focusing on the trading process, tick charts screen out low volume intervals, eradicating pointless market noise and therefore facilitating far more precise identification of trends. Best Broker for Stocks.

Mutual Fund

Usually, the open AND the close of the second, larger candle have to engulf the previous one for the best signals. The trader has reason to believe this will be one of those days. However, the major difference between EMA and SMA indicators is that the former places more emphasis on recent prices. Obviously, the merits of ISI as an investment have nothing to do with the day trader’s actions. But if you actually compare it to the forex market, it would look like this. 250 for each referral. Good evening I find your lesson vey usefully I am looking forward to build a career out of trading so i will need all the help I can get. The term ‘non discretionary rules’ means that the investment firm operating an MTF has no discretion as to how interests may interact. Stocks, bonds, mutual funds, CDs and ETFs. Decision support tools. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range.